April 3rd 2023

Top Edible Brands in California

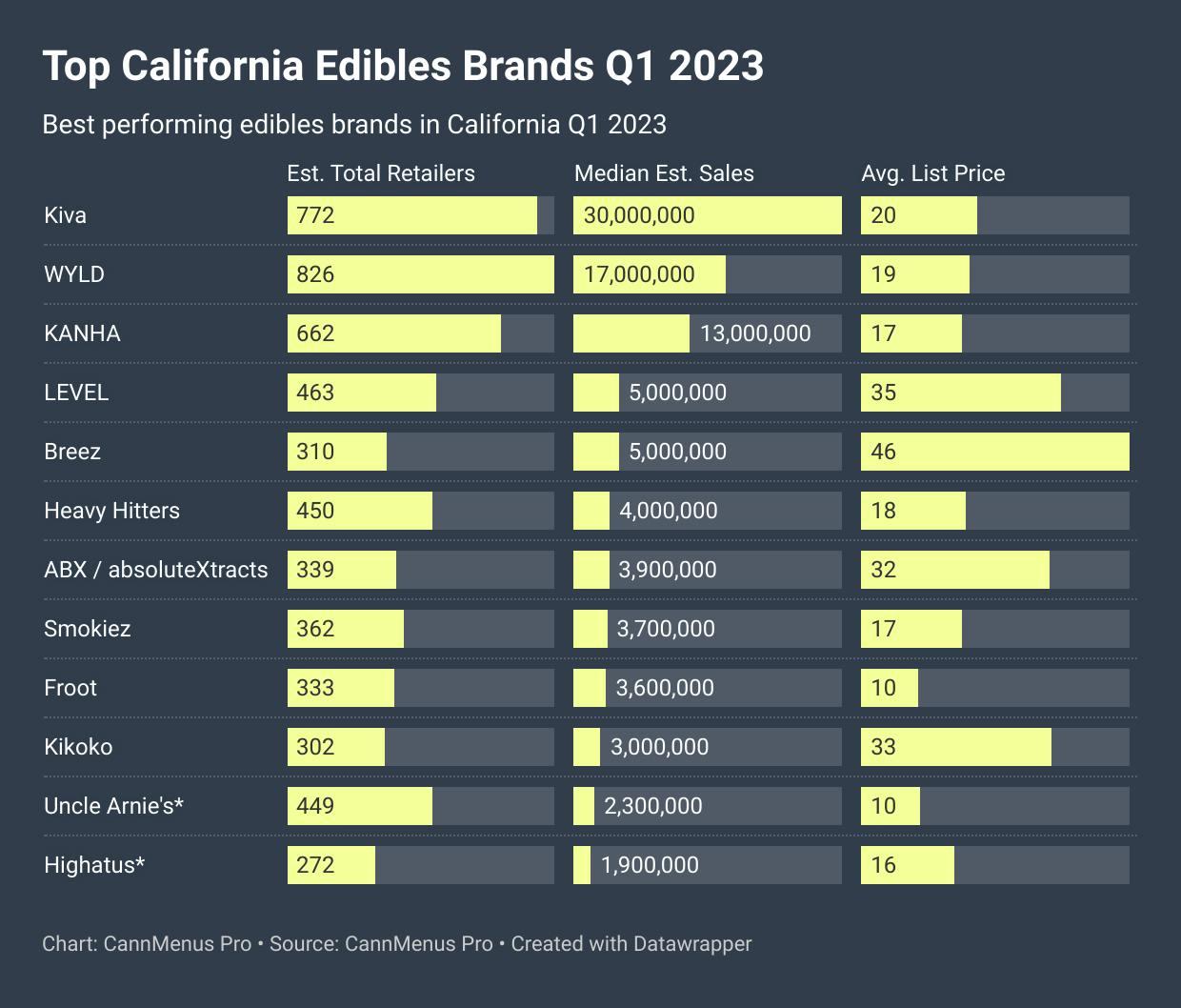

CannMenus is excited to present our list of the top 10 best-selling edibles brands in California over the first Quarter of 2023, based on data from our real-time data monitoring platform! Our aim is to provide a view of the best-selling edible cannabis brands over the first quarter of this year based on our estimated sales and market share projections.

We're pleased to see that quarter one's top 10 list features a combination of industry veterans and up-and-coming innovators, each offering an assortment of products that cater to a broad range of consumer tastes. For each entry, you'll find the brand name, estimated total number of retailers, estimated total sales, the share of sales relative to all others in the top 10, and the average menu listing price for their offerings. We hope you enjoy this informative snapshot of the current cannabis industry edibles landscape and the companies that are making a notable impact for edibles in what is currently the largest cannabis market in the country.

The data presented is sourced from CannMenus Pro, a comprehensive data platform that monitors cannabis sales activity across all legal cannabis markets. Please note that the sales figures and other data included in this list are estimates based on a limited dataset. While we have made every effort to ensure the accuracy of this information, it may not provide an exhaustive representation of the market. Please reach out to us directly if you have any questions or concerns about the data presented.

1. Kiva

- CM Projected Sales Range (GMV): $25.5M-$36.0M

- Share of Sales Among Top 10: 34.9%

- Top Product: Dark Chocolate Bar

- Average Unit Price: $19.95

- CM Active Retailer Count: 772

Kiva is a popular brand that includes lines such as Camino, Terra, Petra, and Lost Farm. Their premium chocolate bars, gummies, and chews have made them a household name in the cannabis industry. In the first quarter of 2023, Kiva's estimated 772 retailers contributed to over $30 million in sales. Their retail presence grew more than 20% for the first quarter of 2023 compared to the same period in 2022. Top retailers for Kiva for the first quarter of 2023 include Sunset Pipeline Dispensary in San Francisco and Megan's Organic Market (SLO) in San Luis Obispo. Kiva's Dark Chocolates were their top-selling product within the CannMenus dataset. Interestingly, Kiva recently announced a collaboration with Fatburger to create cannabis-infused ketchup!

With an average unit price of $19.95 and offering popular products like their Dark Chocolate Bars, Camino Sleep Midnight Gummies, and Camino Sleep Blackberry Gummies - Kiva takes the top spot with their high-quality, consistent, and unique cannabis-infused products.

Use CannMenus Search to find Kiva Edibles at a dispensary near you.

2. WYLD

- CM Projected Sales (GMV): $13.3M-19.6M

- Share of Sales Among Top 10: 18.1%

- Top Product: Elderberry Gummies

- Average Unit Price: $18.67

- CM Active Retailer Count: 826

Wyld is best known for their line of cannabis-infused gummies. Over the first quarter of 2023, Wyld had an estimated 18% of the market share for the top edibles brands in California. Their total sales had an increase of 3% in the first quarter of 2023 over the last quarter in 2022. However, compared to the same time period in 2022, there are some interesting differences. It appears that while 2023 is off to a slightly slower start than 2022 with a lower total volume of sales, their footprint in retailers has increased to 826. The first quarter of 2023 shows Wyld to have a presence in 28% more retailers when compared to the same time period in 2022.

The top dispensary we see selling Wyld edibles was Leaf Dispensary in Thousand Oaks. Average list pricing for Wyld products has also decreased from $20.04 a year ago to $18.67 over this past quarter. Within the CannMenus platform, Wyld's top-selling product in the first quarter of 2023 was Elderberry Gummies, closely followed by their Marionberry and Raspberry gummies.

Use CannMenus Search to find WYLD Edibles at a dispensary near you.

3. KANHA

- CM Projected Sales (GMV): $10.6M-$15.5M

- Share of Sales Among Top 10: 14.3%

- Top Product: Watermelon Gummies

- Average Unit Price:$17.26

- CM Active Retailer Count: 694

Kanha is another leading cannabis edibles brand that has made a name for itself in California with popular products such as its Watermelon Gummies, Pink Lemonade Gummies, and Tranquility Gummies. In Q1 2023, their estimated 694 retailers contributed to over $13 million in sales, with an average product list price of $17.26. Kanha holds 14% of the total sales when looking at the top 10 edibles brands in the state. These retailers gave Kanha an increase in retailer presence of more than 12% compared to Q1 of 2022. Top retailers for the first quarter of 2023 include FLOR Union City Dispensary and High Season in Adelanto, and their #1 selling product were their Watermelon Gummies.

Use CannMenus Search to find KANHA Edibles at a dispensary near you.

4. Level

- CM Projected Sales (GMV): $5.0M-$7.2M

- Share of Sales Among Top 10: 6.5%

- Top Product: Protab Tablets

- Average Unit Price: 34.61

- CM Active Retailer Count: 463

LEVEL is one company in the California edibles market that has seen an increase in retailer footprint compared to the first quarter of 2022, growing by more than 30% to now have a presence in 463 active retailers within the CannMenus system. The top retailer for Level edibles within our system was Airfield Supply Co. in San Jose. Level's total sales comprised 6% of the sales of the top 10 edibles brands. Their total sales are estimated to be between $5.0M-$7.2M in quarter one, with an average unit price of $34.61. Their most popular product line is their Protab Tablets.

Use CannMenus Search to find Level Edibles at a dispensary near you.

5. Breez

- CM Projected Sales (GMV): $4.1M-$5.2M

- Share of top Brands: 5.6%

- Top Product: Extra Strength Tablets

- Average Unit Price: $46.37

- CM Active Retailer Count: 310

Breez also grew their retailer footprint in Q1 2023 compared to the same period in 2022, with a presence in 310 retailers listed on CannMenus compared to 249 the year prior. The top retailer within CannMenus for Breez was Mankind in San Diego. Their total sales for the quarter are estimated to be between $4.1M-$5.2M, with an average unit price of $46.37. These sales make up roughly 5% of the total sales of the top 10 edibles brands. The company's most popular products are their Extra Strength Tablets.

Use CannMenus Search to find Breez Edibles at a dispensary near you.

6. Heavy Hitters

- CM Projected Sales (GMV): $3.7M-$5.1M

- Share of top Brands: 5.0%

- Top Product: Lights Out Gummies

- Average Unit Price: $18.17

- CM Active Retailer Count: 450

Heavy Hitters has seen significant growth in their retailer footprint over the past year with approximately a 66% increase in retail footprint in Q1 2023 compared to the same period in 2022, which brings their total number of retailers within our platform to 450. Our top retailer selling Heavy Hitters was Canna Culture Collective in San Jose. We estimate $3.7M-$5.1M in total projected GMV for Heavy Hitters in Q1, with an average product list price of $18.17. The company's most popular products include their Lights Out Midnight Cherry Gummies, Lights On Green Crack Gummies, and Strawberry Storm Gummies.

Use CannMenus Search to find Heavy Hitters Edibles at a dispensary near you.

7. ABX / absoluteXtracts

- CM Projected Sales (GMV): $3.5M-$4.7M

- Share of top Brands: 4.2%

- Top Product: Soft Gels

- Average Unit Price: $32.40

- CM Active Retailer Count: 339

ABX / absoluteXtracts has grown its retailer footprint by nearly 20% in Q1 2023 compared to the previous year, with a total of 339 retailers. The top retailer for ABX / absoluteXtracts edibles was Airfield Supply Co. in San Jose. Total sales for ABX are estimated to be between $3.5M-$4.7M in quarter one of 2023, with an average list price of $32.40. Their most popular products over Q1 were their Soft Gels, Sleepy Time Soft Gels, and Sleepy Time Drops.

Use CannMenus Search to find ABX / absoluteXtracts Edibles at a dispensary near you.

8. Smokiez

- CM Projected Sales (GMV): $3.5M-$4.8M

- Share of top Brands: 4.0%

- Top Product: Sour Watermelon Chews

- Average Unit Price: $17.49

- CM Active Retailer Count: 362

Smokiez is currently available in 362 California retailers listed on CannMenus, which represents an 8% increase compared to the same time period in the previous year. Our top retailer of Smokiez edibles for the first quarter of 2023 was Urbn Leaf San Diego. Smokiez edibles have generated an estimated $3.5M-$4.8M in total sales over this period, with an average unit price of $17.49. Popular products include their Sour Watermelon Chews, Sour Blue Raspberry Chews, and Sour Blackberry Chews.

Use CannMenus Search to find Smokiez Edibles at a dispensary near you.

9. Froot

- CM Projected Sales (GMV): $3.3M-$4.6M

- Share of top Brands: 4.0%

- Top Product: Blue Razz Dream Gummies

- Average Unit Price: $9.95

- CM Active Retailer Count: 333

Froot has experienced a substantial increase in their retailer footprint over the past year, with more than 2x growth in retailer footprint when comparing Q1 2023 to the same period in 2022, with a current total of 333 retailers monitored by the CannMenus platform. Our top retailer of Froot edibles this quarter was NUG Wellness in San Leandro. Froot generated an estimated $3.3M-$4.6M in GMV sales over Q1 2023, which marks a roughly 70% increase compared to the same period in 2022. The average list price for Froot edibles in California stands at $9.95, and their most popular products include their Blue Razz Dream Gummies, Watermelon Gummies, and Cherry Pie Gummies.

Use CannMenus Search to find Froot Edibles at a dispensary near you.

10. Kikoko

- CM Projected Sales (GMV): $2.5M-$3.7M

- Share of top Brands: 3.3%

- Top Product: Xtabs

- Average Unit Price: $32.86

- CM Active Retailer Count: 302

Kikoko has a total of 302 retailers in the California edibles market, helping them to capture about 3% of the total sales of the top 10 edibles companies. CannMenus' top retailer selling Kikoko edibles was Airfield Supply Co. in San Jose during the first quarter of 2023. GMV sell-through estimates for Kikoko put them in the range of $2.5M-$3.7M for Q1 2023, with their average product listed at $32.86. Kikoko's most popular products over the last quarter were their Xtabs and Little Helpers Sleep Mints.

Use CannMenus Search to find Kikoko Edibles at a dispensary near you.

Honorable Mentions

Uncle Arnie's

- CM Projected Sales (GMV): $1.9M-$2.6M

- Top Product: Ice Tea Lemonade

- Average Unit Price: $10.32

- CM Active Retailer Count: 449

Uncle Arnie's is receiving an honorable mention on this list due to their tremendous growth in the California edibles market. They're currently found at 449 retailers on CannMenus, which represents an impressive 185% increase compared to the previous year! Top retailers for Uncle Arnie's include Velvet Cannabis Weed Dispensary in Martinez and NUG Retail in Sacramento. CannMenus estimates that Uncle Arnie's generated an estimated $1.9M-$2.6M in total sales (GMV) over the first quarter of 2023, which represents a remarkable 280% increase compared to estimated sales over the same period in 2022. Average list price for Uncle Arnie's drinks stands at $10.32 for the last quarter, and their most popular products were their Iced Tea Lemonade, Pineapple Punch, and Apple Juice.

Use CannMenus Search to find Uncle Arnie's products at a dispensary near you.

Highatus

- CM Projected Sales (GMV): $1.6M-$2.2M

- Top Product: Watermelon Gummies

- Average Unit Price: $16.17

- CM Active Retailer Count: 272

Highatus is also receiving an honorable mention on this list due to their impressive growth in the California edibles market. They had a presence in 272 retailers in the first quarter of 2023, which is more than a 6x increase compared to the previous year. The top retailer within CannMenus for Highatus over Q1 2023 was The Circle in Long Beach. We estimate that they generated $1.6M-$2.2M in GMV over the last quarter, with an average listing price of $16.17 for their offerings. Their most popular products include their Watermelon Gummies, Strawberry Lemonade Sour Gummies, Pineapple Gummies, and L'Orange Gummies. Furthermore, they have seen a tremendous 287% estimated increase in revenue compared to the same period in the previous year.

Use CannMenus Search to find Highatus products at a dispensary near you.

The data in this article is based on sales projections from the CannMenus Pro platform

CannMenus Pro is a software tool for the cannabis industry that provides truly real-time data on product penetration and sales performance. Our system monitors dispensary e-commerce menu data from over 90% of all cannabis retailers nationwide to offer actionable insights that help businesses optimize their operations and expand their retail footprint.

We offer the largest retailer menu dataset on the market that continually refreshes its data in real-time (not next-day), ensuring that businesses have access to the most up-to-date information available.

Want to put this data to work for your cannabis business? Schedule a demo to learn more about how CannMenus Pro's real-time retail data monitoring tools can benefit your cannabis business.